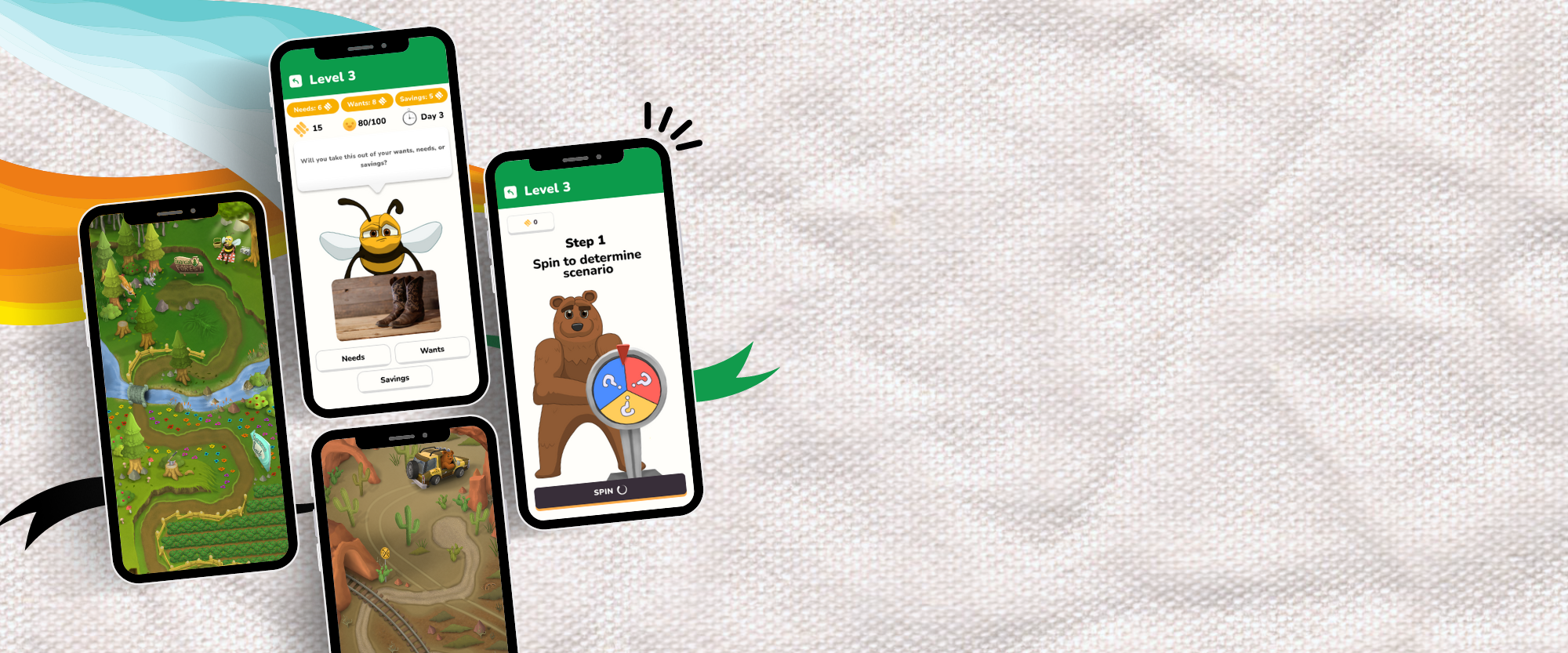

Begin your gamified financial learning adventure!

To launch Spring 2025

Keep Streaks

Earn Bee-Bux for each consecutive day you log in and improve your fiscal-knowledge-standing with HIVE!

Various levels

Our Budgeting, Investing, and Banking Worlds all included in full for free will help you get the fundamentals down for your transition to financial independence!

Support the environment

7.5% of our profits, whether from our Plume tier, ads, or donations after launch, will be contributed to a charity dedicated to saving the bees!

Why does HIVE matter?

--

Why does HIVE matter? --

-

According to the Financial Industry Regulatory Authority (FINRA), about 66% of the American population is considered financially illiterate. Being financially literate allows an individual to be better prepared for financial roadblocks, which, in turn, decreases the chances of personal economic distress. That’s 2/3 who are doomed, making education on the topic crucial!

-

It's estimated that about 78% of Americans live paycheck to paycheck. Student loan debt is about $1.5 trillion for more than 44 million borrowers. Overall, Americans are approximately $12.58 trillion in debt. If teens are not taught how to manage their money, why are they expected to be able to manage their money when they turn 18? Financial literacy isn’t something that can be taught overnight, making modern education more critical than ever!

-

According to The 2018 National Financial Capability Study, respondents between 18 and 34 were most likely to feel stress, with women more likely than men to experience anxiety. On top of that, scores on this test have gone down every three years. 42% got four out of five correct in 2009, compared to 39% in 2012 and 37% in 2015. These statistics will have to look out when we launch Spring 2025 with our equitable and youth-driven efforts!

Invited to pitch at: